You signed in with another tab or window. Reload to refresh your session.You signed out in another tab or window. Reload to refresh your session.You switched accounts on another tab or window. Reload to refresh your session.Dismiss alert

Copy file name to clipboardexpand all lines: docs/articles/expensify-classic/bank-accounts-and-credit-cards/business-bank-accounts/Add-a-Business-Bank-Account-(AUD).md

+12-11

Original file line number

Diff line number

Diff line change

@@ -7,24 +7,25 @@ description: This article provides insight on setting up and using an Australian

7

7

A withdrawal account is the business bank account that you want to use to pay your employee reimbursements.

8

8

9

9

_Your policy currency must be set to AUD and reimbursement setting set to Indirect to continue. If your main policy is used for something other than AUD, then you will need to create a new one and set that policy to AUD._

10

+

10

11

To set this up, you’ll run through the following steps:

11

12

12

-

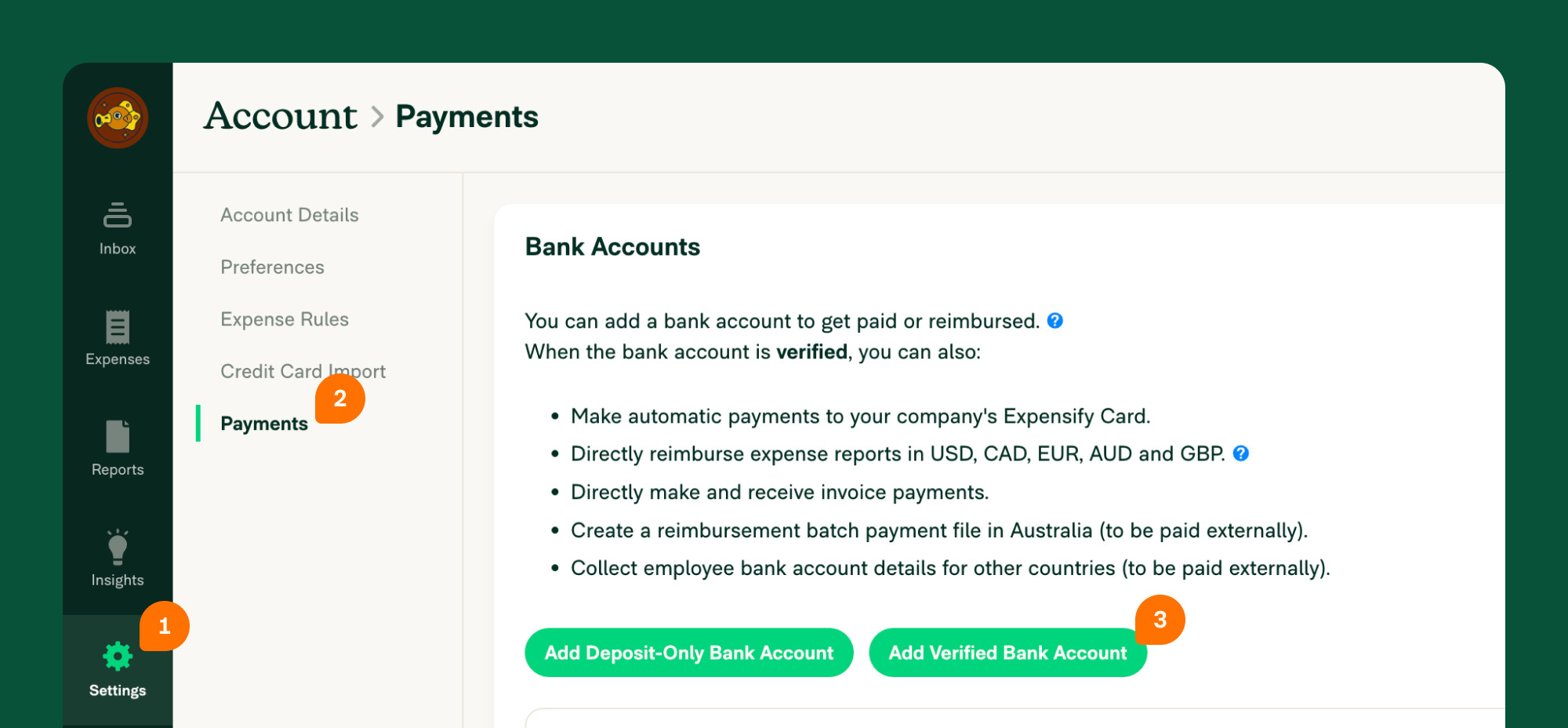

1. Go to *Settings > Your Account > Payments* and click *Add Verified Bank Account*

13

+

1. Go to **Settings > Your Account > Payments** and click **Add Verified Bank Account**

13

14

{:width="100%"}

14

15

15

16

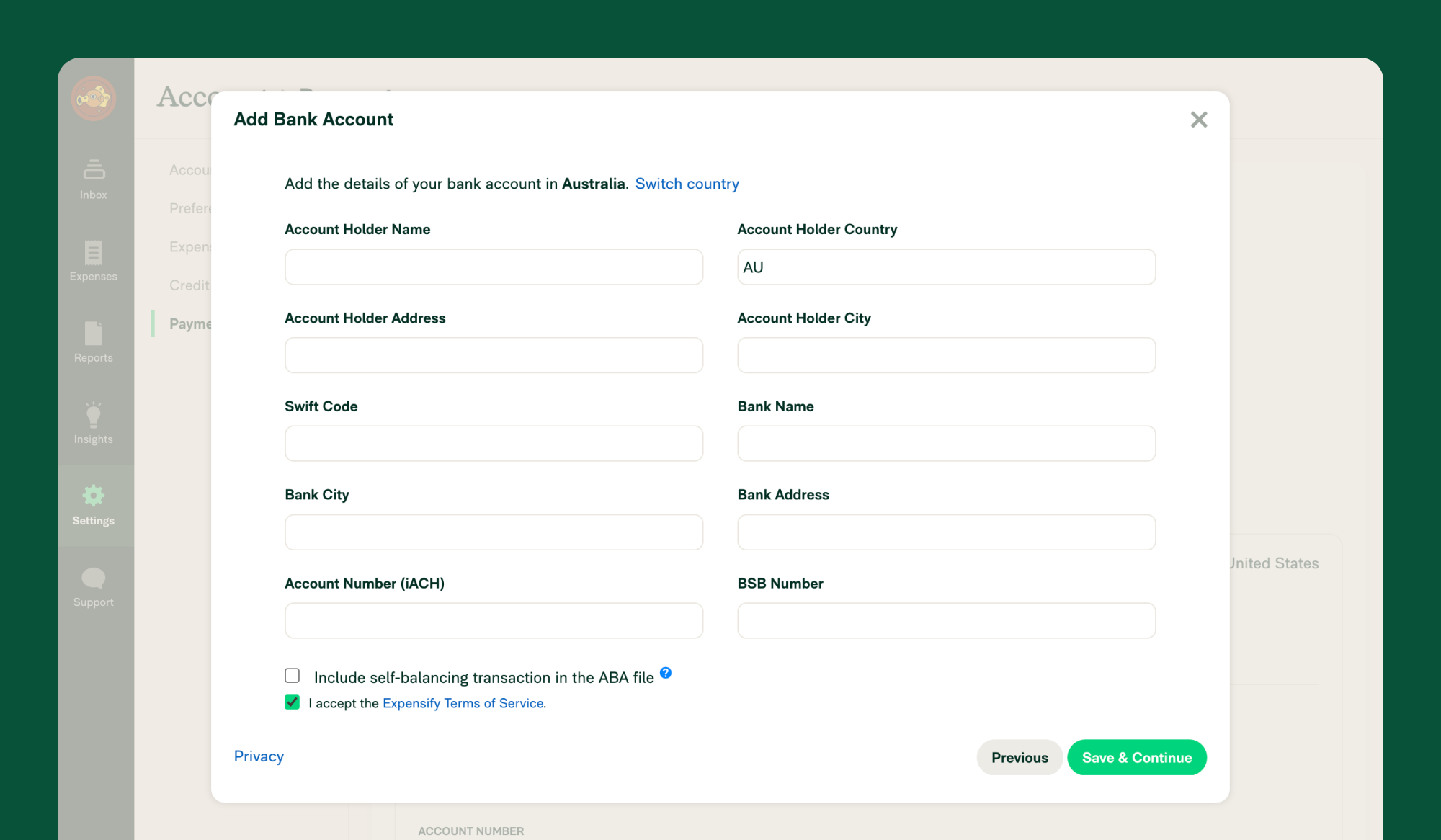

2. Enter the required information to connect to your business bank account. If you don't know your Bank User ID/Direct Entry ID/APCA Number, please contact your bank and they will be able to provide this.

16

17

{:width="100%"}

17

18

18

-

3. Link the withdrawal account to your policy by heading to *Settings > Policies > Group > [Policy name] > Reimbursement*

19

-

4. Click *Direct* reimbursement

19

+

3. Link the withdrawal account to your policy by heading to **Settings > Policies > Group > [Policy name] > Reimbursement**

20

+

4. Click **Direct reimbursement**

20

21

5. Set the default withdrawal account for processing reimbursements

21

22

6. Tell your employees to add their deposit accounts and start reimbursing.

22

23

23

24

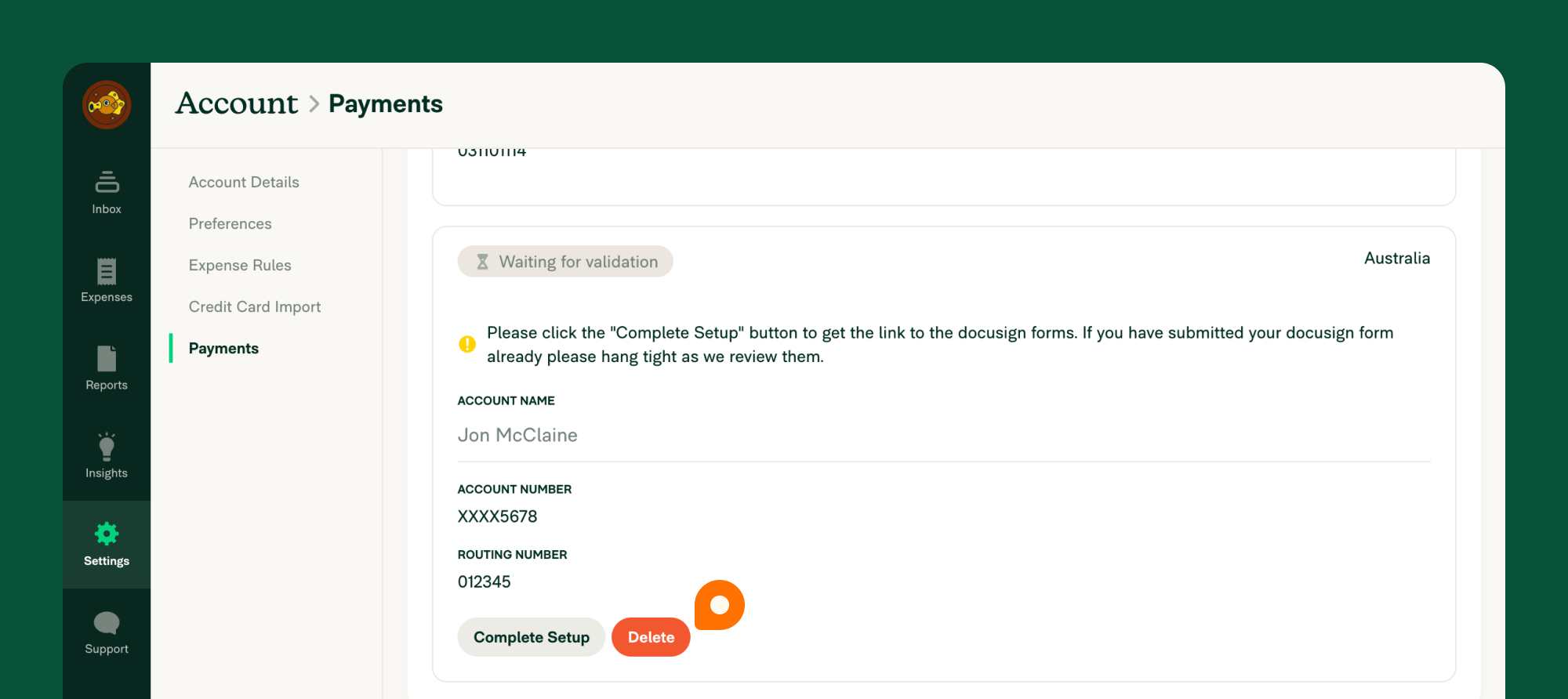

# How to delete a bank account

24

25

If you’re no longer using a bank account you previously connected to Expensify, you can delete it by doing the following:

25

26

26

27

1. Navigate to Settings > Accounts > Payments

27

-

2. Click *Delete*

28

+

2. Click **Delete**

28

29

{:width="100%"}

29

30

30

31

You can complete this process either via the web app (on a computer), or via the mobile app.

@@ -34,14 +35,14 @@ You can complete this process either via the web app (on a computer), or via the

34

35

35

36

If you are new to using Batch Payments in Australia, to reimburse your staff or process payroll, you may want to check out these bank-specific instructions for how to upload your .aba file:

36

37

37

-

ANZ Bank - [Import a file for payroll payments](https://www.anz.com.au/support/internet-banking/pay-transfer-business/payroll/import-file/)

38

-

CommBank - [Importing and using Direct Entry (EFT) files](https://www.commbank.com.au/business/pds/003-279-importing-a-de-file.pdf)

-NAB - [Quick Reference Guide - Upload a payment file](https://www.nab.com.au/business/online-banking/nab-connect/help)

42

+

-Bendigo Bank - [Bulk payments user guide](https://www.bendigobank.com.au/globalassets/documents/business/bulk-payments-user-guide.pdf)

43

+

-Bank of Queensland - [Payments file upload facility FAQ](https://www.boq.com.au/help-and-support/online-banking/ob-faqs-and-support/faq-pfuf)

43

44

44

-

*Note:* Some financial institutions require an ABA file to include a *self-balancing transaction*. If you are unsure, please check with your bank to ensure whether to tick this option or not, as selecting an incorrect option will result in the ABA file not working with your bank's internet banking platform.

45

+

**Note:** Some financial institutions require an ABA file to include a *self-balancing transaction*. If you are unsure, please check with your bank to ensure whether to tick this option or not, as selecting an incorrect option will result in the ABA file not working with your bank's internet banking platform.

0 commit comments